How does a hard money loan work? Hard money loans (or private money loans) are short-term loans made to real estate investors to help them quickly acquire their next project, scale their business, and maximize returns. The private lenders that make these loans are asset-based which means they are focused most on the property’s value and cash-flow potential. If you want to learn what it takes to close on a property with a hard money loan, keep reading!

Here’s what we’ll cover:

How is hard money different than a mortgage?

Hard money loans offer many advantages over traditional sources of capital. These are the key areas in which they differ and some of the ways you can benefit:

- Higher investor return – lower equity required and fewer out of pocket expenses help to maximize investor returns.

- Speed – these loans can be made much faster, in as little as 48 hours provided clean title

- Borrower requirements – there is often much less paperwork and fewer items that are needed for document collection and verification. This also helps the process move more quickly

- Terms – the hard money loan is generally short-term (6-12 months) and you can expect to pay a higher interest rate

- Repair funding – lenders will consider funding up to 100% of repairs that might be needed

Where should you start?

To begin, you should network and find a lender that is interested in working with you. Do this before you’ve found your next great investment opportunity and are in need of a loan. Great places to find hard money lenders in your area are local Facebook real estate investor groups, investor networking events, and referrals from other seasoned real estate investors.

Once you build those relationships with lenders in your area, many can even provide a great second opinion on your next deal. Focus on communicating these items to your lender.

- Experience – don’t sweat it if it’s your first deal. Be upfront about what types of projects you think you are capable of handling given your background and potential prior experience in the industry

- Scope – do you want to do smaller cosmetic flips or are you interested in more comprehensive rehabs? What purchase price range are you targeting and why?

- Exit strategy – are you interested in flipping properties or building a portfolio of cash flowing rental assets? This is important to lenders because they are focused on the exit – how and when will you return their capital?

- Target markets – where are you looking for your next deal? Lenders may or may not have geographical preferences or restrictions

- Sourcing your deal – what resources are you using to look for your next project? Hard money lenders often have great networks and can help connect you with potential sources of new deals

Get pre-approved!

It’s not necessary, but applying for pre-approval with a lender for a hard money loan strengthens your chance of closing the next property. Many investors purchase off-market deals, and your offer is more likely to be accepted if you have a Proof of Funds or Pre-approval Letter from your preferred private lender. Here’s what you can expect to get pre-approved:

- Loan application – online forms are becoming more common to collect preliminary loan application information such as contact info, work experience, real estate portfolio, and credit stats

- Discussion with the lender – if you haven’t already been in touch with your preferred private lender, a loan officer will reach out to get to know you and provide an overview of the process for getting pre-approved

- Document collection – some lenders may require the collection of certain items to speed up the process once you have a deal you are ready to make on offer on. Getting this pre-screened by the lender allows you to move faster and be more competitive. These items may include identification, entity documents, proof of liquidity, and a real estate schedule

- Proof of Funds – if you meet a lender’s criteria for qualification, they may be able to provide you a Proof of Funds or Pre-approval Letter. This letter may be valid for a specified period of time, contain an approved funding amount, and refer to a specific property or be more general in nature

Now that you have your Proof of Funds letter, it’s time to go deal hunting!

I’ve found a great deal, now what?

It’s a good idea to let your lender know about your deal even before you submit an offer for your next investment property. Your loan officer can give you some good feedback and be prepared once your offer is accepted. If your lender has a borrower portal to optimize the loan request submission, here is some of the information you’ll need. Keep in mind not all of it may be available at the time you submit the request, and that is OK!

- Property address

- Entity and signer information

- Requested loan amounts including advanced at close and repair budget

- Estimated closing date and requested loan term

- Any available documents and attachments – property photos, valuation analysis (CMA), repair budget, purchase agreement, and assignment agreement (if applicable)

How is the hard money loan value determined?

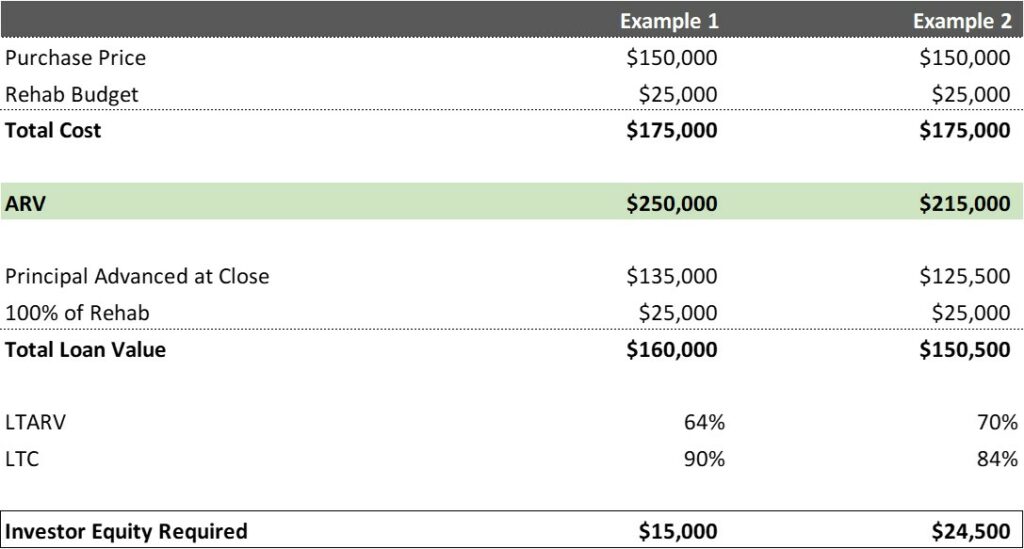

The lender will either perform their own property valuation analysis or order an appraisal. This analysis will also consider any planned rehab which results in an After Repair Value (ARV). Based on this determination, lenders will generally set their maximum Loan Value at 70-75% of the ARV. This percentage is considered the Loan-to-After Repair Value (LTARV). Private lenders expect the investor to also perform their own valuation analysis and usually the ARV is established in cooperation between lender and borrower.

Hard money lenders also like to see some “skin in the game” – especially for newer or less experienced borrowers. This means you can expect to bring at least 10% of the purchase price to close. This would make the Loan-to-Cost (LTC) 90%.

Most lenders will not front repair costs, but they will consider funding up to 100% of the rehab budget, subject to the maximum LTARV.

Loan Value Examples

In these two examples, let’s assume the Purchase Price and Rehab budget are the same and that the private lender will also fund 100% of the rehab. The only difference is the determined ARV. In Example 1, the higher ARV means that the lender is willing to fund 90% of the Purchase Price. In Example 2, the max LTARV would be exceeded if the lender funded 90% of the Purchase Price and 100% of the rehab. So the lender caps the total Loan Value at 70% of the ARV and the difference is made up with a higher equity amount brought to close by the investor.

Let’s get that deal closed!

If your offer is accepted, your loan officer will work with you to collect any outstanding items and will get in touch with the title company that will handle the closing process. This will usually be chosen by the seller. The lender will issue a set of Lender Instructions detailing loan amounts, fee schedule, and other required information necessary for the title company to prepare the title commitment and settlement statement. The last remaining item that is usually needed from the investor is evidence of insurance that is usually paid on the same day as closing.

Once you’ve signed the contract to buy the property, these are the major steps to get you across the finish line:

- Title is opened (usually by the seller or their agent) to begin looking for any potential issues with the clean transfer of ownership from the seller

- Depending on your lender, an appraisal and credit report will be ordered. Some lenders are able to close without the appraisal and also do not have a minimum credit score

- Your private lender collects any outstanding items with evidence of insurance usually being last

- Lender will issue their Lender Instructions to pave the way for the title company to provide a Title Commitment

- The settlement statement detailing disbursement of funding amounts is approved by all parties

- The parties wire their respective amounts

- Buyer and seller sign closing documents

- Lender approves funding once closing documents have been approved

If you are unfamiliar with the standard loan documents, these are the common documents prepared by the lender that you can expect to sign at the closing table.

- Promissory Note – outlines the terms of the loan such as interest rate, maturity date, and any pre-payment penalty

- Deed of Trust – agreement between the lender and borrower to give the property to a trustee. The trustee holds the property until the borrower pays of the loan

- Personal Guaranty – a promise by the borrower to fulfill the obligations of the loan

- Repair Draw Agreement – outlines the manner in which the rehab funds are held by the lender and funds disbursed to the investor as work is completed

- Affidavit of Commercial Purpose – statement by the borrower that the property is an investment property and will not be considered a homestead or for personal purposes

What happens after closing?

If your loan includes rehab funding held in escrow, you will submit draw requests to the lender as stages of your rehab are completed. The draw request includes itemized values based on the approved rehab budget. Once a request is received, the private lender will send out an inspector to verify the work is completed and of good workmanship quality. After the inspection is approved, the lender will advance you funding for the completed work. Generally, you can expect this process to take 1-2 days.

Get started with a hard money loan today!

If you are a real estate investor, hard money loans can be a great tool to help you scale your business and maximize your returns. While the loan rate may be higher, it is expected that these are short-term loans that you should be able to move in and out of quickly as you cycle through projects. Finding a great lender that can be a long-term partner is a key part of your success. Look for lenders that are local (know your market) and are direct (lend their own capital and do not broker your deal).

If you are ready to submit a loan request or are interested in learning more about hard money loans, apply today.